IPR as an Asset: Why Patents are Your Startup’s Real Capital

In the high-velocity world of startups, a company’s most valuable asset is rarely its physical infrastructure or initial revenue, instead, it is its Intellectual Property (IP). For a founder, Intellectual Property Rights (IPR) are far more than a legal checkbox. They are a strategic tool designed to build “channels” around innovation, attract venture capital, and secure a critical seat at the negotiating table.

From a patent professional’s perspective, this “moat” is technically defined through claim construction. A robust IP strategy does not merely seek a granted patent; it seeks to establish a defensible perimeter that balances broad, independent claims with specific, dependent ones. This technical layering ensures that the startup’s “freedom to operate” is preserved while creating significant barriers to entry for competitors.

Furthermore, in the eyes of investors, a startup’s IP portfolio serves as a proxy for its long-term viability. Beyond protecting a technical “how-to,” patents and trademarks act as intangible assets that can be leveraged for licensing, collateralized for financing, or used as a defensive shield in the event of infringement litigation.

In this blog, we will walk you through the technical and legal nuances of IPR specifically tailored for the startup ecosystem covering everything from the “First-Inventor-to-File” paradigm to the strategic importance of Provisional Applications in securing priority dates.

The Technical Pillars: Beyond the Basics

While many understand that patents protect “inventions,” seasoned analysts focus on claim construction. Your patent is only as strong as its claims; broad claims might be rejected due to Prior Art (any evidence that your invention was already known), while too-narrow claims allow competitors to “design around” your technology.

Before launching, every startup must conduct a Freedom to Operate (FTO) analysis. This technical search ensures that your product doesn’t infringe on the “live” patents of others. Failing to do this is like building a house on someone else’s land, you might be forced to tear it down just as you start to scale.

Real-World Stakes: Lessons from the Courts

History is littered with startups that won the tech race but lost the IP war. Consider the early 2000s case of ConnectU v. Facebook. The founders of ConnectU alleged that their source code and ideas were misappropriated. Because they lacked formal copyright registrations and clear Invention Assignment Agreements at the start, their legal leverage was significantly weakened, leading to a settlement far below what a “protected” company might have commanded.

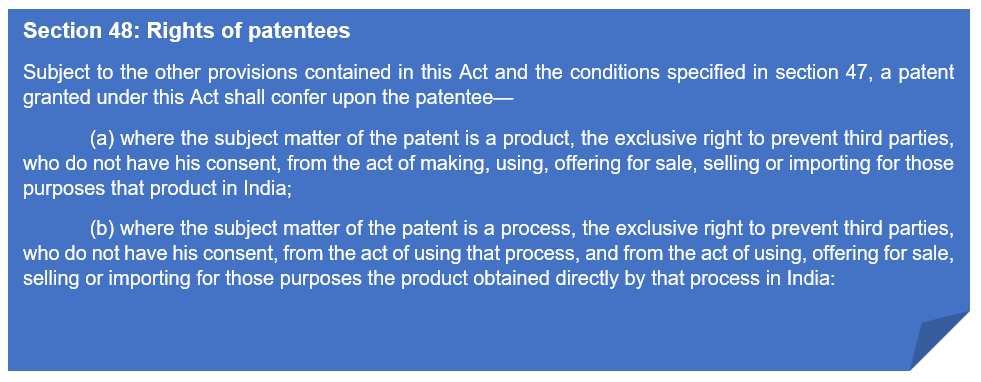

In more recent 2024-2025 jurisprudence, the Delhi High Court’s ruling in Novo Nordisk v. Dr. Reddy’s highlights the power of Section 48 of the Indian Patents Act. The court granted an injunction against domestic sales of a patented drug but allowed manufacturing for export to non-patent jurisdictions. For a biotech or hardware startup, this underscores a critical lesson: your IP strategy must be global, not just local.

Avoid the “Prosecution History Estoppel” Trap

One technical pitfall many founders overlook is Prosecution History Estoppel. During the patent “prosecution” (the back-and-forth with the Patent Office), you might be tempted to narrow your claims significantly just to get the patent granted. However, any territory you “surrender” in these arguments cannot be reclaimed later in court through the Doctrine of Equivalents. In short: what you say to the examiner stays with you forever.

Note: Prosecution History Estoppel is a legal doctrine in patent law that prevents a patent owner from later broadening the scope of their patent claims after having narrowed them during the patent application process.

Conclusion

For startups, IPR is not a legal formality, it is real capital. It defines your market position, strengthens your valuation, protects your innovation, and shapes your negotiation power. A well-planned patent strategy transforms ideas into enforceable business assets, giving startups the confidence to scale, attract investors, and compete globally.

In today’s innovation economy, startups that treat IP as strategy, not paperwork, are the ones that truly own their future.

0 Comments